In today’s fast-paced business environment, maintaining accurate and efficient financial records is not just a necessity—it’s absolutely crucial for a successful enterprise at virtually any level. A good accounting software system plays a vital role in achieving this accuracy and efficiency. This article will outline the critical need for having an all-inclusive accounting software and how it can transform the financial management of your business, especially important for establishing set procedures of your organization still in its infancy.

Thank you for reading this post, don’t forget to subscribe!Efficient Financial Operations

Fundamentaly, good accounting software streamlines all aspects of financial management, from invoicing and payroll to expenses and tax reporting. By automating these routine tasks, it reduces the likelihood of human error, thus ensuring more accurate financial records. The time saved for business owners and finance teams utilizing these automation features allows both owners and administrators to focus on strategic planning rather than getting bogged down in day-to-day accounting tasks; an oldie but still applicable, “Is running your business getting in the way of running your business?”.

Financial Metrics In Real-Time

One of the single most significant advantages of modern accounting software is the provision of real-time financial data paired with the ability to quickly and effectively capitalize on opportunities. Businesses can monitor their financial health anytime, with up-to-date information on cash flow, expenses, and revenue. This immediate access to financial insights aids in making informed decisions quickly, a crucial factor in the dynamic business landscape where opportunities and challenges arise swiftly, and vanish just as quickly.

Accurate and SimpleCompliance and Reporting

Tax regulations and financial reporting requirements are complex and ever-changing. Effective accounting software helps businesses stay compliant by automatically updating to reflect the latest tax laws and providing templates for financial reports that meet statutory requirements. Not to metion simplification of the tax filing process by accurately tracking all deductible expenses and providing detailed financial reports, reducing the risk of errors, penalties and completely avoidable stress for a new entrepreneur trying their hand in stating a new business.

Improved Accuracy and Reduction of Errors

Manual accounting processes are prone to errors, which can lead to significant issues such as misreported taxes, inaccurate financial statements, and mismanaged budgets. Good accounting software minimizes these risks by automating calculations and transactions, ensuring accuracy and consistency across all financial documents. This reliability strengthens the credibility of the business with stakeholders, including investors, lenders, and regulatory bodies. The ability to confidently share finances with decision makers while applying for financing and loan products can mean the difference between hearing your peers claim it was a “good try” starting a new company, and a “excellent, books look great, how much do you need” said to you over a desk in a banker’s office.

Scalability

Scalability is a word i use often when posed with the question of consistent business growth. Businesses grow, their financial management needs become more complex. Good accounting software is scalable, designed to grow with the business. It can accommodate an increasing volume of transactions and more sophisticated financial reporting and analysis needs without a corresponding increase in overhead or complexity in financial management processes, which is a blessing considering the monumental effort necessary in most other aspects of expanding and scaling a relativly new business.

Data Security

Financial data is sensitive and requires robust protection sparing no expense. Accounting security and standard operational policys surrounding bookkeeping is one of the greatest dangers to the future of an otherwise sound organization. Good accounting software offers advanced security features, including data encryption and secure access controls, ensuring that financial information is protected against unauthorized access and data breaches. This security is especially critical in an era where cyber threats are increasingly sophisticated, extremely common, and constantly evolving.

In Conclusion

Investing in quality accounting software is investing in the financial health and operational efficiency of your business. It not only simplifies and automates financial processes but also provides valuable metrics that drive informed decision-making. By enhancing accuracy, compliance, and security, good accounting software supports consistent and sustainable growth all while building a strong foundation for future success for yourself and your family. In a business environment where efficiency and accuracy are absolutely essential paramount, the right accounting software is not just a tool—it’s an essential apparatus in achieving your business objectives to afford you the freedom we all strive to achieve in business.

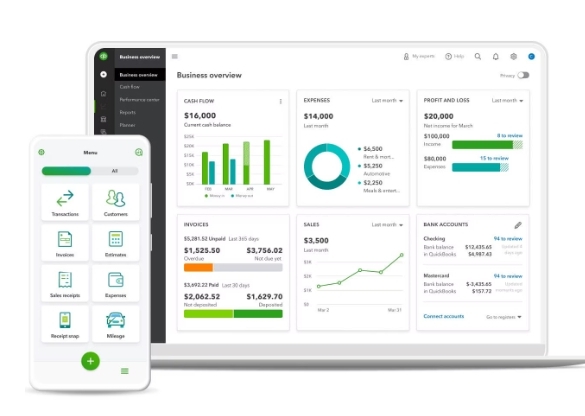

Having started several businesses in construction; without a doubt Quickbooks is the way to go for bookkeeping. Click here to check out current promotions.